Les cookies nous permettent d'offrir nos services. En utilisant nos services, vous acceptez notre utilisation des cookies.

Votre panier est vide.

Les produits stars

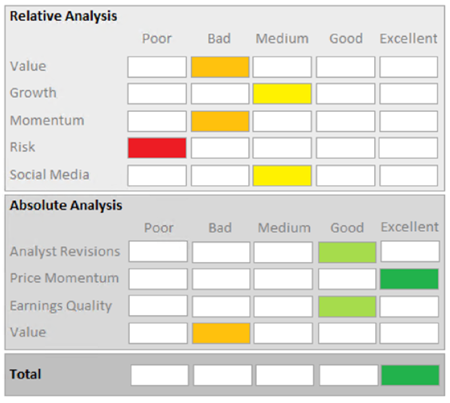

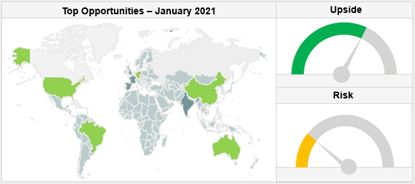

10 Top Equity Ideas - January 2021

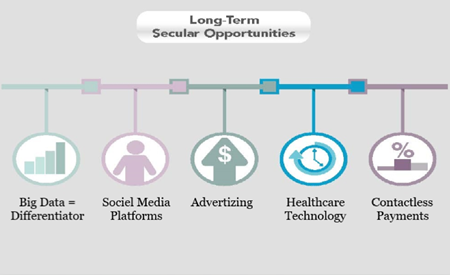

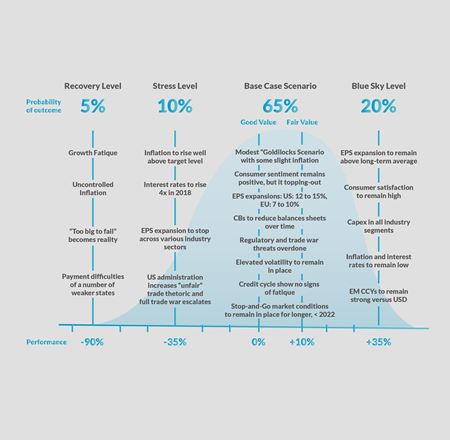

For good or bad, the headlines came from the US. While the function of the social network is being questioned and reviewed, the long-term outlook does not change—users and corporations will make use of media facilities more than ever.

With the Senate and the White House now under Democratic control, investors found renewed optimism in the prospect of a further, Democratic-led, much-needed fiscal stimulus. This reinforces our positive stand on equities, in particular on small caps, which should benefit from consumer support.

124,00 (CHF)

CBDC - FinTech

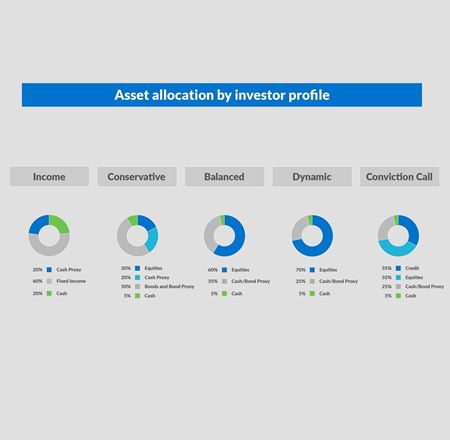

Speculations about digital currencies being the next big thing made us work on deeper analysis and research. We concluded that blockchain technology-backed business models are scoping the future financial flows because about 85% of the world's central banks are actively working on some strategies to implement Central Bank Digital Currency (CBDC).

The present payment system needs a refresh, and digitalizing all of it appears opportune. In the absence of any valuable investment opportunity in CBDC, we consider opportunities in the digital payment ecosystem, in particular the service enablers. As of today, there are about 130 identified companies that are presently working or expected to work in the field of digital payments.

19,00 (CHF)

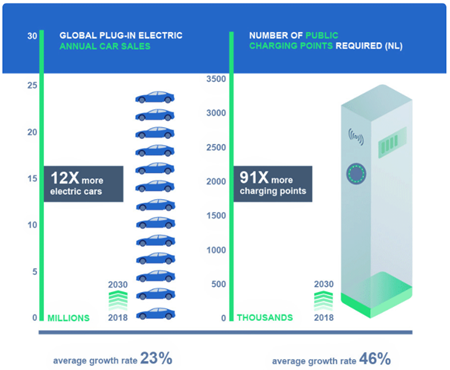

Building a resilient electric grid

Extreme temperatures, fires, and floods are taking a toll on electric grids. The next generation of electric grids is expected to be resilient in these specific cases. Upgrading and transforming the existing infrastructure and transitioning energy from high to very low voltage systems will require large capex.

35,00 (CHF)

Novel technologies

Advanced technologies are the backbone of all newly established industries. In the drive to capture carbon, do the electrolysis, integrate wind and solar energy, and gain energy from waste management, partnerships with tech-enabled companies and start-ups are needed. Also, we see that promising projects are expected to be funded by new and existing venture capital funds so that projects can reach mass market status in a short period of time.

35,00 (CHF)

Luxury-car-transition-opportunities

The new EV-EOM are the latest disruptors. Can established legacy OEM adapt to keep up with the increased EV demand and the red-hot tech services? We have reviewed and analysed over 100 companies. Here is the ranking and their competitive edge.

249,00 (CHF)

Sustainability of constructions

Forty percent of global CO2 emissions are due to fossil energy consumption that is in one way or another related to the construction industry. The re-design and process optimization, the use of recycled products and equipment, and the use of alternative products will help increase efficiencies.

35,00 (CHF)

Decarbonization of the oil and gas sector

Multiple companies have elaborated strategies that aim at going “green”. As a result of these undertakings, we expect new energies, such as hydrogen, will emerge.

35,00 (CHF)