Les cookies nous permettent d'offrir nos services. En utilisant nos services, vous acceptez notre utilisation des cookies.

Votre panier est vide.

Long-Term Secular Trends

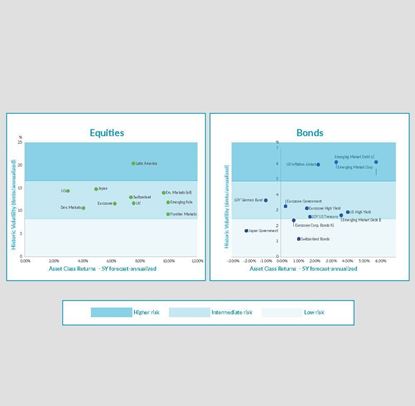

Long-Term Secular Trend investment solutions in various currencies for any kind of risk profile. Investment strategies have, by definition, a given level of risk for which an investor is rewarded over time. Investors should bear in mind that investments can go up and down irrespective of market conditions and that he is rewarded according to the level of risk accepted.

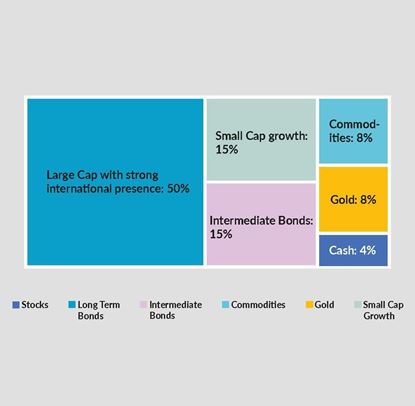

Asset allocation during period with raising inflation

| Strategy summary | ||||||

| Profile | USD - Balanced | |||||

| Invested Amount | 2'500'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | 10 / 5 / 3 | |||||

| Weighted Av. Upside Potential (Blue Sky) | please ask | |||||

| Performance YTD Strategy (%) | 7.78 | |||||

| Performance YTD Benchmark (%) | 4.87 | |||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | Benchmark | |||||

| Add. information | ||||||

E&OE - Data as per June 30, 2019

275,00 (CHF)

Dispersion Strategy

| Strategy summary | ||||||

| Profile | USD - Dispersion Strategy | |||||

| Invested Amount | 5'000'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | - / - / 20 | |||||

| Weighted Av. Upside Potential (Blue Sky) (%) | > 30 | |||||

| Performance YTD Strategy (%) | -73.81 | |||||

| Performance YTD Benchmark (%) | 89.72 | |||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | Benchmark | |||||

| Add. information | Purpose of Product: Hedging | |||||

Weighted estimates are based on broker input – realization of such is subject to market conditions.

E&OE - Data as per June 30, 2019

275,00 (CHF)

Taking advantage from Long-Term Return Opportunities

| Strategy summary | ||||||

| Profile |

Long-Term Return Opportunities |

|||||

| Invested Amount | min > 5'000'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | 3 / 20 / 2 | |||||

| Weighted Av. Upside Potential (Blue Sky) (%) | > 20 | |||||

| Performance YTD Strategy (%) |

no strategy at present |

|||||

| Performance YTD Benchmark (%) | ||||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | Benchmark | |||||

| Add. information | please call for quote | |||||

Weighted estimates are based on broker input – realization of such is subject to market conditions.

E&OE - Data as per June 30, 2019

325,00 (CHF)

71 companies involved in Bigdata and Business Intelligence — trends that unfold now

Accessing Data as Market Differentiator

The Data Decade (Huberty) was accelerated as a result of the pandemic. The 10-year investment cycle gained speed and precision in areas such as artificial intelligence, machine learning, robotics, automation, and industrial internet of things.

It is about sink or swim!

Companies were forced to leverage into technology fields in order to maintain some modicum of activity during the lockdown.

Social-distancing measures have heightened the need to access remote data, interactions, and process steps. IDC expects an 87% compound annual growth in total AR/VR spending over the next 4 years, reaching USD 128 billion 2 years from now. While the use of AI/AR will be very niche, such as in consumer gaming, a far more pronounced application can be expected in sectors such as healthcare, retail, real estate, and education.

194,05 (CHF)

51 companies involved in Social Media — Have a look beyond FAANG

Small- and medium-sized businesses (SMB's) were hardest hit by the lockdowns. While proximity to their most valuable customers is certainly an advantage, getting information about their products and services out to the wider community will remain a challenge.

We see considerable opportunities for social media platforms to provide plug-and-play solutions for SMB's. At present, just a fraction of these companies actively use advertising services. Moving forward, this number is expected to grow.

For social apps, building a digital town is a feasible challenge because the required elements work very well independently; these include real-time inventory management, contactless payment systems, and delivery logistics.

120,00 (CHF)

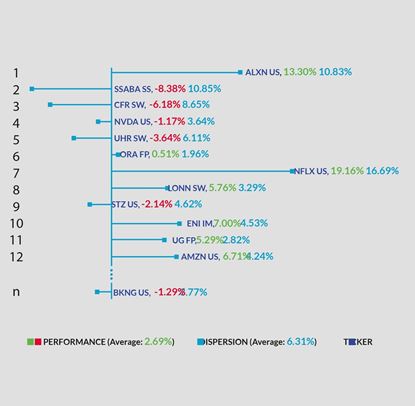

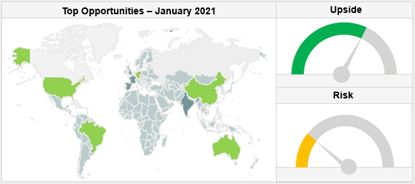

10 Top Equity Ideas - January 2021

For good or bad, the headlines came from the US. While the function of the social network is being questioned and reviewed, the long-term outlook does not change—users and corporations will make use of media facilities more than ever.

With the Senate and the White House now under Democratic control, investors found renewed optimism in the prospect of a further, Democratic-led, much-needed fiscal stimulus. This reinforces our positive stand on equities, in particular on small caps, which should benefit from consumer support.

124,00 (CHF)

- 1

- 2