Les cookies nous permettent d'offrir nos services. En utilisant nos services, vous acceptez notre utilisation des cookies.

Votre panier est vide.

Tailor Made

BOT engineered investment solutions in various currencies for any kind of risk profile. Investment strategies have, by definition, a given level of risk for which an investor is rewarded over time. Investors should bear in mind that investments can go up and down irrespective of market conditions and that he is rewarded according to the level of risk accepted.

Tailor Made

Tailor Made strategies are available via the fast-track section https://www.irisos.com/#fasttrack (please refer to the page link below).

Pricing is a function of the size of the mandate, profile, and the eligible investment opportunities.

Appelez-nous pour connaître le prix

51 companies involved in Social Media — Have a look beyond FAANG

Small- and medium-sized businesses (SMB's) were hardest hit by the lockdowns. While proximity to their most valuable customers is certainly an advantage, getting information about their products and services out to the wider community will remain a challenge.

We see considerable opportunities for social media platforms to provide plug-and-play solutions for SMB's. At present, just a fraction of these companies actively use advertising services. Moving forward, this number is expected to grow.

For social apps, building a digital town is a feasible challenge because the required elements work very well independently; these include real-time inventory management, contactless payment systems, and delivery logistics.

120,00 (CHF)

71 companies involved in Bigdata and Business Intelligence — trends that unfold now

Accessing Data as Market Differentiator

The Data Decade (Huberty) was accelerated as a result of the pandemic. The 10-year investment cycle gained speed and precision in areas such as artificial intelligence, machine learning, robotics, automation, and industrial internet of things.

It is about sink or swim!

Companies were forced to leverage into technology fields in order to maintain some modicum of activity during the lockdown.

Social-distancing measures have heightened the need to access remote data, interactions, and process steps. IDC expects an 87% compound annual growth in total AR/VR spending over the next 4 years, reaching USD 128 billion 2 years from now. While the use of AI/AR will be very niche, such as in consumer gaming, a far more pronounced application can be expected in sectors such as healthcare, retail, real estate, and education.

194,05 (CHF)

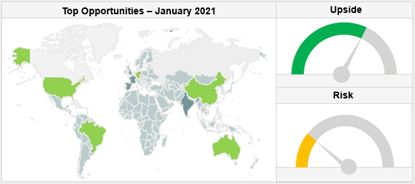

10 Top Equity Ideas - January 2021

For good or bad, the headlines came from the US. While the function of the social network is being questioned and reviewed, the long-term outlook does not change—users and corporations will make use of media facilities more than ever.

With the Senate and the White House now under Democratic control, investors found renewed optimism in the prospect of a further, Democratic-led, much-needed fiscal stimulus. This reinforces our positive stand on equities, in particular on small caps, which should benefit from consumer support.

124,00 (CHF)

32 companies involved in Telemedicine and MedTech — here’s where things stand

Healthcare Technology

Many analysts with a following expect Healthcare to be strong in 2021. While legacy healthcare sector companies are predominately “Value,” new entrants are by definition “Growth.” We strongly believe that these companies will continue to lead the way across the entire sector well beyond 2021.

Recent developments suggest that healthcare technology companies will make ever-increasing use of machine learning (i.e., artificial intelligence), cloud computing, and Big Data.

As with other industry activities, the impact of pandemic stay-at-home orders has catapulted some little-known companies into the spotlight. For example, companies specializing in chemical simulation software can help scientists discover new molecular compounds much more quickly than in the past. Although many of these technologies were available in the past, their actual use has burgeoned during the pandemic.

Healthcare deals in the air

In 2020, M&A activity in the healthcare sector was below average; one can expect that 2021 will display some catch-up effects. In fact, reputable investors have begun to express a growing interest in the sector. As of the end of 2020, there are approximately 100 Special-Purpose Acquisition Companies (SPAC) that have a purse of USD 100 billion standing by with the aim of seeking M&A opportunities. Get the analyses of the companies involved here.

112,50 (CHF)