Les cookies nous permettent d'offrir nos services. En utilisant nos services, vous acceptez notre utilisation des cookies.

Votre panier est vide.

Produits taggés avec 'global secular trends'

Asset Allocation ASIA

| Strategy summary | ||||||

| Profile | USD - Dynamic | |||||

| Invested Amount | 2'500'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | - / 20 / 3 | |||||

| Weighted Av. Upside Potential (Blue Sky) | please ask | |||||

| Performance YTD Strategy (%) | please ask | |||||

| Performance YTD Benchmark (%) | 14.5 | |||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | above benchmark | |||||

| Add. information | ||||||

125,00 (CHF)

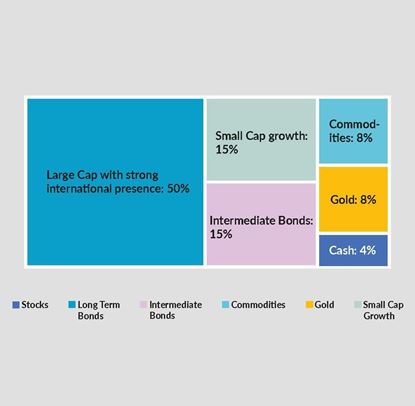

Asset allocation during period with raising inflation

| Strategy summary | ||||||

| Profile | USD - Balanced | |||||

| Invested Amount | 2'500'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | 10 / 5 / 3 | |||||

| Weighted Av. Upside Potential (Blue Sky) | please ask | |||||

| Performance YTD Strategy (%) | 7.78 | |||||

| Performance YTD Benchmark (%) | 4.87 | |||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | Benchmark | |||||

| Add. information | ||||||

E&OE - Data as per June 30, 2019

275,00 (CHF)

Asset Allocation EUROPE

| Strategy summary | ||||||

| Profile | EUR - Dynamic | |||||

| Invested Amount | 2'500'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | 2 / 15 / 3 | |||||

| Weighted Av. Upside Potential (Blue Sky) | 10.35 | |||||

| Performance YTD Strategy (%) | 18.30 | |||||

| Performance YTD Benchmark (%) | 3.86 | |||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | Benchmark | |||||

| Add. information | ||||||

E&OE - Data as per June 30, 2019

125,00 (CHF)

Asset Allocation GLOBAL

| Strategy summary | ||||||

| Profile | USD - Global | |||||

| Invested Amount | 2'500'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | 2 / 15 / 3 | |||||

| Weighted Av. Upside Potential (Blue Sky) | 15.35 | |||||

| Performance YTD Strategy (%) | 17.94 | |||||

| Performance YTD Benchmark (%) | 7.18 | |||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | Benchmark | |||||

| Add. information | ||||||

Weighted estimates are based on broker input – realization of such is subject to market conditions.

E&OE - Data as per June 30, 2019

175,00 (CHF)

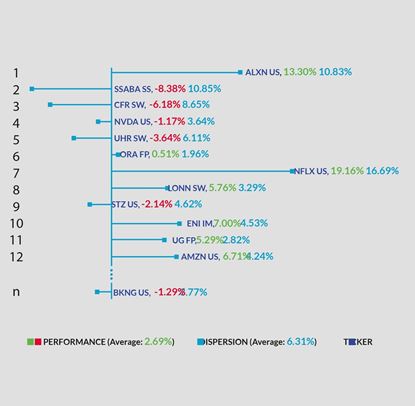

Dispersion Strategy

| Strategy summary | ||||||

| Profile | USD - Dispersion Strategy | |||||

| Invested Amount | 5'000'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | - / - / 20 | |||||

| Weighted Av. Upside Potential (Blue Sky) (%) | > 30 | |||||

| Performance YTD Strategy (%) | -73.81 | |||||

| Performance YTD Benchmark (%) | 89.72 | |||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | Benchmark | |||||

| Add. information | Purpose of Product: Hedging | |||||

Weighted estimates are based on broker input – realization of such is subject to market conditions.

E&OE - Data as per June 30, 2019

275,00 (CHF)

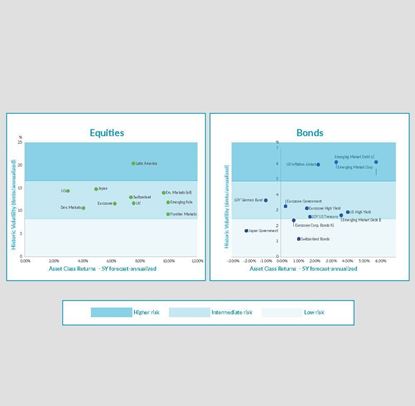

Taking advantage from Long-Term Return Opportunities

| Strategy summary | ||||||

| Profile |

Long-Term Return Opportunities |

|||||

| Invested Amount | min > 5'000'000 | |||||

| # of holdings (bonds / Equities / Structured Solutions) | 3 / 20 / 2 | |||||

| Weighted Av. Upside Potential (Blue Sky) (%) | > 20 | |||||

| Performance YTD Strategy (%) |

no strategy at present |

|||||

| Performance YTD Benchmark (%) | ||||||

| Level of risk |

|

|||||

| Level of risk vs. Benchmark | Benchmark | |||||

| Add. information | please call for quote | |||||

Weighted estimates are based on broker input – realization of such is subject to market conditions.

E&OE - Data as per June 30, 2019

325,00 (CHF)