Les cookies nous permettent d'offrir nos services. En utilisant nos services, vous acceptez notre utilisation des cookies.

Votre panier est vide.

Produits taggés avec 'social media stocks'

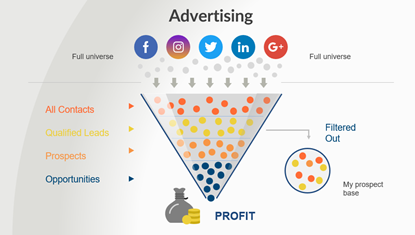

41 companies involved in Advertizing — trends and opportunities

TV Advertising Moving to Online Companies

TV networks and content producers manage an annual USD 163 billion ad spend (of which about USD 63 billion goes to the US market). Until 2020, the allocation management event occurred each year in May – but COVID-19 ruined not only this year's event, but also the allocation plans.

With major sports events being cancelled, postponed or scheduled with very short notice, advertisers are forced to adhere to a more proactive allocation model.

COVID-19 may have come at an opportune time, as changes were already in the air. Disruptors offer a growing number of consumers, better measurability, and real-time pricing. Competing Digital platforms will be measured in key areas, such as

- Consistent delivery and latency rate,

- High-quality reach, and

- Coverage of consumer segments.

92,50 (CHF)

51 companies involved in Social Media — Have a look beyond FAANG

Small- and medium-sized businesses (SMB's) were hardest hit by the lockdowns. While proximity to their most valuable customers is certainly an advantage, getting information about their products and services out to the wider community will remain a challenge.

We see considerable opportunities for social media platforms to provide plug-and-play solutions for SMB's. At present, just a fraction of these companies actively use advertising services. Moving forward, this number is expected to grow.

For social apps, building a digital town is a feasible challenge because the required elements work very well independently; these include real-time inventory management, contactless payment systems, and delivery logistics.

120,00 (CHF)

71 companies involved in Bigdata and Business Intelligence — trends that unfold now

Accessing Data as Market Differentiator

The Data Decade (Huberty) was accelerated as a result of the pandemic. The 10-year investment cycle gained speed and precision in areas such as artificial intelligence, machine learning, robotics, automation, and industrial internet of things.

It is about sink or swim!

Companies were forced to leverage into technology fields in order to maintain some modicum of activity during the lockdown.

Social-distancing measures have heightened the need to access remote data, interactions, and process steps. IDC expects an 87% compound annual growth in total AR/VR spending over the next 4 years, reaching USD 128 billion 2 years from now. While the use of AI/AR will be very niche, such as in consumer gaming, a far more pronounced application can be expected in sectors such as healthcare, retail, real estate, and education.

194,05 (CHF)