Les cookies nous permettent d'offrir nos services. En utilisant nos services, vous acceptez notre utilisation des cookies.

Votre panier est vide.

Récemment vus

Long-Term Secular Trends

Long-Term Secular Trend investment solutions in various currencies for any kind of risk profile. Investment strategies have, by definition, a given level of risk for which an investor is rewarded over time. Investors should bear in mind that investments can go up and down irrespective of market conditions and that he is rewarded according to the level of risk accepted.

32 companies involved in Telemedicine and MedTech — here’s where things stand

Healthcare Technology

Many analysts with a following expect Healthcare to be strong in 2021. While legacy healthcare sector companies are predominately “Value,” new entrants are by definition “Growth.” We strongly believe that these companies will continue to lead the way across the entire sector well beyond 2021.

Recent developments suggest that healthcare technology companies will make ever-increasing use of machine learning (i.e., artificial intelligence), cloud computing, and Big Data.

As with other industry activities, the impact of pandemic stay-at-home orders has catapulted some little-known companies into the spotlight. For example, companies specializing in chemical simulation software can help scientists discover new molecular compounds much more quickly than in the past. Although many of these technologies were available in the past, their actual use has burgeoned during the pandemic.

Healthcare deals in the air

In 2020, M&A activity in the healthcare sector was below average; one can expect that 2021 will display some catch-up effects. In fact, reputable investors have begun to express a growing interest in the sector. As of the end of 2020, there are approximately 100 Special-Purpose Acquisition Companies (SPAC) that have a purse of USD 100 billion standing by with the aim of seeking M&A opportunities. Get the analyses of the companies involved here.

112,50 (CHF)

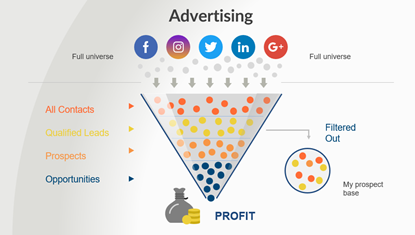

41 companies involved in Advertizing — trends and opportunities

TV Advertising Moving to Online Companies

TV networks and content producers manage an annual USD 163 billion ad spend (of which about USD 63 billion goes to the US market). Until 2020, the allocation management event occurred each year in May – but COVID-19 ruined not only this year's event, but also the allocation plans.

With major sports events being cancelled, postponed or scheduled with very short notice, advertisers are forced to adhere to a more proactive allocation model.

COVID-19 may have come at an opportune time, as changes were already in the air. Disruptors offer a growing number of consumers, better measurability, and real-time pricing. Competing Digital platforms will be measured in key areas, such as

- Consistent delivery and latency rate,

- High-quality reach, and

- Coverage of consumer segments.

92,50 (CHF)

Luxury-car-transition-opportunities

The new EV-EOM are the latest disruptors. Can established legacy OEM adapt to keep up with the increased EV demand and the red-hot tech services? We have reviewed and analysed over 100 companies. Here is the ranking and their competitive edge.

249,00 (CHF)